How to Integrate Payment Gateway into Mobile Apps Making No Mistakes

The world went digital. According to Statista, the number of active mobile users stood at 7 billion in 2021. Mobile applications allow people to get desired products or services just in a few clicks.

In such conditions, businesses can’t stay behind since they miss out on the tidbit of potential customers. And the right solution is to integrate payment gateways into mobile applications to provide in-app purchases ability.

In this post, we’ll discuss how to add payments into mobile apps and what preparation steps it requires.

Payment Gateway Definition

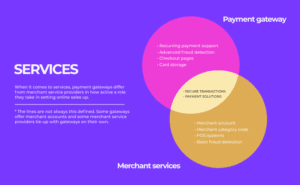

Payment gateway services enable users to make purchases via mobile apps. It serves as an arbiter between a transaction a buyer wants to carry out and the payment transmitter (e.g., financial establishment). Why do parties need such an arbiter? The direct interaction between the mobile platform and payment transmitter is impossible due to security restrictions. Finally, payment gateway solutions are the part of the application that applies encryption to provide the secure processing of users’ data.

The best thing about payment gateways is that companies can easily add payment options to their digital products without taking care of security transactions.

How to Start Mobile Payment Gateway Integration

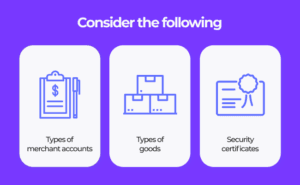

Let’s see what things you should take into account before integrating payment gateways.

Types of Merchant Accounts

Merchant accounts allow users to accept online payments and serve as an online bank account. They keep the money you get from the purchaser in your application (commonly, 3-5 days) and then transmit them to your corporate bank account. If you add payment gateways, the transaction is first checked by the service provider and then delivered to your merchant account.

You can open a merchant account in a bank and integrate payment gateways into it if it’s supported by the bank. Another option is to employ well-known payment gateway providers like PayPal or Stripe, which offer packaged solutions and maintenance merchant accounts to their clients.

Depending on your business needs, there are two types of merchant account you can select from:

Dedicated Merchant Account

This type of account provides you with complete control over your finances. For instance, there is an individual payment processing fee rate depending on your sales amount. Accordingly, the more you sell, the lower the charges are. Besides, a dedicated merchant account enables fast money transactions and processes other financial operations such as account debiting, revision of transaction errors, etc.

However, it’s a costly and time-consuming option. Users will need to pass through multiple checks, including security ones.

Aggregate Merchant Account

This type of account signifies that the money your company makes is united with other businesses. It’s like you share your bank cell with other people. Respectively, you’re limited in finance management, and money withdrawal to your corporate account requires more time. But it’s a low-pricing solution.

Types of Products You Sell

Products you’re offering to the market should also be considered when integrating payment gateways into mobile apps. For example, if you sell digital products, you’ll need to follow Play Store or App Store rules for in-app purchases. The application that’s released on those marketplaces can’t use 3d-party services. Thus, all transactions should be processed through Apple ID or Gmail.

Both platforms submit software engineers with guidelines and proper tools. Apple provides iOS programmers with dedicated frameworks, while Google suggests a specialized API for Android developers. Hence, all transactions will be executed by marketplaces.

On the other hand, if you intend to sell physical goods, the platforms suggest applying payment gateway providers. Payment gateways use special APIs to connect to your app.

Security Certificates

To manage clients’ banking information, you should comply with PCI DSS demands. This document is crucial even if you’re employing a robust security payment gateway. However, to obtain a PCI DSS certificate, you will need to withstand a complex verification process.

Beforehand, you need to ensure that your database encompassing the client’s credit card data meets the PCI DSS requirements. Then you need to remove vulnerabilities that were detected by pentesters. After all the fixes are performed, your organization will be verified by a Qualified Security Assessor company.

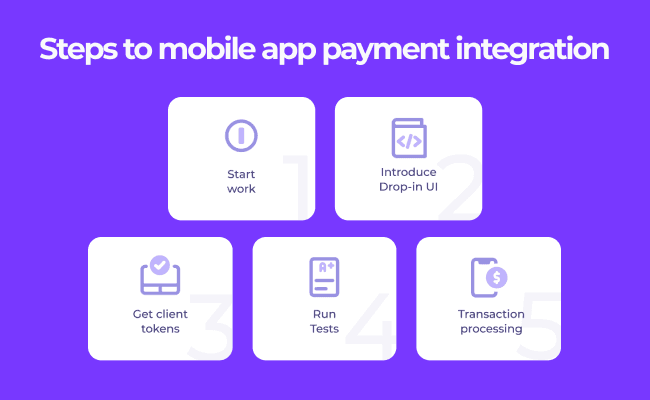

How to Add Payment Gateway into Mobile Application: Step-by-Step

In order to demonstrate how to undertake a payment gateway solution, I took the case of integrating Braintree service into iOS-based apps.

Braintree is a payment gateway service provider acquired by PayPal. The platform comes with different tools and resources to create optimized purchase solutions. In addition, integrating Braintree SDK into mobile platforms makes it possible to accept credit cards and other payment methods such as PayPal.

Now let’s see what steps you should follow to add payments to mobile platforms.

Step #1. Get Started

The Braintree SDK needs to be implemented into the project using one of the build systems like Carthage or Cocoapods.

Step #2. Submit Drop-in UI

Include a few lines to the programming code. You can also customize the UI by tokenizing the credit card information directly. The tokenization key enables clients to tokenize shopping information, so there is no need to produce a new key for every new session.

Step #3. Gain Customer Token

You need to obtain a customer token made by your server according to the query from your application. Generate new customer tokens every time your platform is reset. The token contains the entire configuration, and authorization data allow clients to set the SDK

Step #4. Test Integration Performance

Apply Braintree test card info and one-time numbers to test how the integration works. For this purpose, you need to create a sandbox account. Your credentials will consist of Sandbox merchant ID, public and individual keys.

Step #5. Payments Processing

When handling a transaction, utilize a one-use payment method on your server. How does it work? After you get the customer’s card details, you transmit them to the server, and it employs the information to execute the transaction.

To add payment gateways into Android-based applications, you’ll need to conduct the same steps. The difference lies in the SDK applied. Braintree platform provides individual libraries for Android app payment gateway implementation.

Wrapping Up

Mobile payment gateway integration has many benefits for both customers and business owners as it’s allowed for in-app purchasing and secure money transactions. You only need an experienced software development company that will help you build robust mobile solutions involving money operations.

My name is Katherine Orekhova and I am a technical writer at Cleveroad – mobile app development company. I’m keen on technology and innovations. My passion is to tell people about the latest tech trends in the world of IT.

Pranab Bhandari is an Editor of the Financial Blog “Financebuzz”. Apart from writing informative financial articles for his blog, he is a regular contributor to many national and international publications namely Tweak Your Biz, Growth Rocks ETC.