Why do People Invest in Bonds?

Are you on the lookout for stable investment choices in India’s developing economy? Here’s something to consider: experts like Goldman Sachs are predicting a strong 6.5% economic growth for India. This is expected in the upcoming 2024-25 period, thanks to the private sector’s push.

And guess what? It’s the country’s massive middle class – all 400 million of them – who are steering this ship of growth with their spending and investment power.

So, where does this leave you?

With a landscape that’s blossoming with potential, bonds are becoming a go-to for many. They’re like the steady pillars in the world of investments, offering a sense of security amid the hustle of the stock market.

Keep reading to explore why adding bonds to your portfolio could be a wise move.

Why Should You Invest in Bonds?

If you’re considering ways to increase your savings, bonds may not immediately spring to mind. Yet, they offer several benefits that could be an essential part of your financial planning.

Growing Importance of Bonds in Your Portfolio

Bonds have come a long way, especially in India. The S&P BSE India Government Bond Index saw a 4.7% rise in just the first half of 2023. Our bond market has been getting richer, thanks to more institutional investors, high-net-worth individuals, and family offices getting involved over the past decade.

But it’s not just the big players – bonds can be for everyone. Retail investors have typically favored fixed deposits and post office savings. However, bonds are beginning to attract attention. This interest in bonds is growing, helped by RBI and SEBI’s efforts to deepen the market and boost participation.

Moving forward, the investment landscape is unfolding some compelling prospects. Take green bonds, for example. By February 2023, India had rolled out green bonds valued at $21 billion, with a significant share of this investment coming from private companies.

As for the numbers, the expectations for the 10-year bond yield are to average around 3.60% through 2024.

India’s Emerging Role in Global Bond Markets

As India gears up for a significant shift in its financial landscape, let’s dive into what this means for bond investors and the broader market.

India’s entry into the JP Morgan Government Bond Index-Emerging Markets (GBI-EM) in June 2024 marks an important moment. This inclusion is set to transform the Indian bond market.

It’s about integrating India’s economy more closely with the global financial system, expanding the investor base for government securities. This will in turn make India an attractive hub for international investors.

About the Index: The GBI-EM index is a significant player in the global market, tracking the performance of government bonds issued by emerging economies. It’s a yardstick for investors to measure the health of the bond markets in these countries.

India’s Inclusion: 23 Indian government bonds worth USD 330 billion are getting ready to be part of this esteemed index. India’s weight in the index could hit 10% in the GBI-EM Global Diversified and about 8.7% in the GBI-EM Global. This step puts Indian bonds on the map for around USD 236 billion worth of global funds.

Possible Returns and Performance

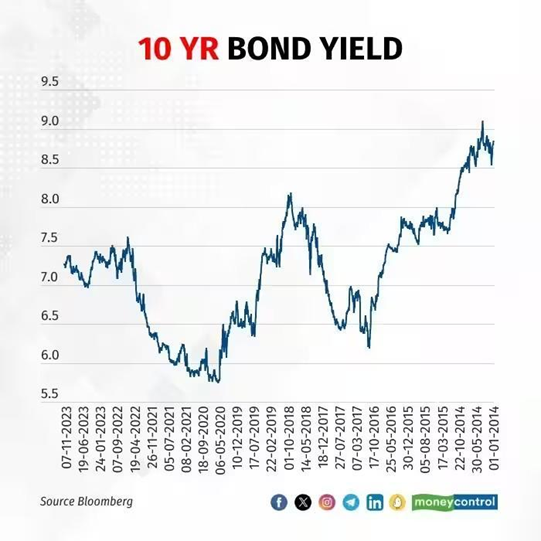

When you’re looking at bonds, the potential returns are a big draw. The graph below shows the journey of 10-year bond yields, which reflects the returns you’d expect from long-term investments in government bonds.

Bond yields fluctuated between a low of around 6% to a high of nearly 9.5% over time. Notably, yields took a sharp dive in early 2020, indicating that bond prices likely increased at that time.

Source: moneycontrol.com

Understanding these patterns is important. In simple terms, when the chart shows a dip like it did around 2020, you can expect bond prices to go up.

On the flip side, when yields spike, as seen in the recent uptick, bond prices typically drop. This back-and-forth movement is key when considering bonds for your investment mix.

Common Pitfalls to Avoid

Investing in bonds doesn’t come without hiccups. Be cautious of these common mistakes when investing in bonds:

- Interest rate changes are tricky; when they go up, bond prices usually go down.

- The financial health of the bond issuer matters too, since their troubles can affect your investment.

- There’s also the chance the issuer might pay back the bond early, altering your expected income.

- Rising costs of living can diminish the value of the money you get from bonds.

- Lastly, don’t overlook fees. If they’re too high, they can significantly reduce your profits.

Here’s how to stay on top:

- Diversify your bonds to spread risk across different issuers and maturities.

- Stay vigilant against biases like recent events influencing your decisions or seeking information that only supports your beliefs.

- Timing the market is a gamble – instead, consider a ladder strategy, staggering maturities to manage interest rate changes.

- And always keep an eye on fees, opting for cost-effective options.

Final Thoughts

“An investment in knowledge pays the best interest,” Benjamin Franklin once said. Platforms like Appreciate Wealth can be your ally in this learning journey.

With tools and insights available on an online trading app, even novice investors can navigate the bond market with confidence.

Yogesh is a Co-Founder at Appreciate, a fintech platform helping Indians achieve their financial goals through globally diversified one-click investing.