New 1099 Filing Requirements that Businesses and Contractors Need to Know for Tax Year 2022

The new year is right around the corner and so is the start of the tax season. This is the time of year when you must undergo the process of determining which tax forms you must file for your business. A major component of staying compliant with the IRS is being aware of any form updates and filing accordingly.

Filing tax forms for your business is inevitable, however, this doesn’t mean the process has to be overly stressful. In this article, we will cover the basics of the Form 1099 Series and the requirements of the most common forms. We will also cover the updates for the tax year 2022 that you need to understand before filing.

Before we cover the updates, here is a helpful look at the 1099 Series of forms.

What is the Form 1099 Series?

The 1099 Form series is a collection of IRS tax forms that report various different types of payments made to individuals or entities other than regular employees over the course of the year. These payments can be earnings from freelancing or independent contracts, rental incomes, interest received from banks, tax refunds from state and local government, and more.

Payers (your business) are required to file the applicable 1099 with the IRS and the payee (recipient of the payment) before the deadline. The deadlines for 1099 forms vary, however, most of them must be distributed to recipients by January 31st. In the case that a deadline falls on a weekend or federal holiday, the next business day becomes the deadline.

These are the most common forms in the 1099 series, you will likely come across them in the course of doing business.

Form 1099-NEC

Form 1099-NEC is used to report any non-employee compensation payments of $600 or more made to independent contractors, freelancers, or sole proprietors during the calendar year. Form 1099-NEC has the earliest deadline of the 1099 forms, it must be filed with the IRS AND distributed to recipients by January 31, 2023.

Form 1099-MISC

Form 1099-MISC reports certain types of miscellaneous payments made to individuals or entities during the year. The payments reported on 1099-MISC are miscellaneous payments made in the course of business during the calendar year.

This includes rent, awards, payments to attorneys, and more. Form 1099-MISC must be distributed to recipients before January 31st and filed with the IRS before February 28th (if paper filing) or March 31st (if e-filing).

Form 1099-K

Form 1099-K must be filed by Payment Settlement entities to report the commercial payments made to individuals or business entities through payment card transactions or third-party network transactions of at least $600 during the year. All payments of $600 or greater must be reported, regardless of the number of transactions.

Form 1099-K must be distributed to recipients before January 31st and filed with the IRS before February 28th (if paper filing) or March 31st (if e-filing).

Form 1099-INT

Form 1099-INT is used by banks and other financial institutions to report interest payments made to businesses or individuals of at least $10 during the calendar year.

Now that we have covered the most common 1099 forms you may encounter in the course of doing business, let’s take a deep dive into any and all updates to these forms for the upcoming tax season.

Form 1099-INT must be distributed to recipients before January 31st and filed with the IRS before February 28th (if paper filing) or March 31st (if e-filing).

Changes to 1099 Forms for the 2022 Tax Year

While there were a few forms to these tax forms for the 2021 tax year, there are a couple more updates for the 2022 tax year, here is an overview.

Form 1099-K Reporting Threshold Has Been Reduced

The updates to 1099-K reporting are without question the most notable for the 2022 tax year. The requirements for filing this form have been changed quite a bit by the IRS.

In past years, Form 1099-K was only required to be filed when a payee received an online payment of at least $ 20,000 and 200 applicable transactions in a calendar year.

However, the IRS has drastically lowered the reporting threshold of Form 1099-K to $600 regardless of the number of transactions per the American Rescue Plan Act of 2021.

In other words, a single commercial transaction over $600 must now be reported to the IRS.

| Tax Year | Threshold | Number of Transactions |

| Before 2022 Tax Year | $20,000 / year | $200 |

| After 2022 Tax Year | $600/ year | No limits |

Changes to Form 1099-MISC Box Numbers

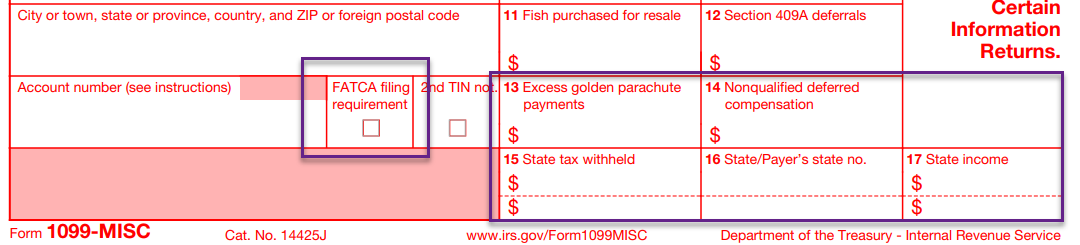

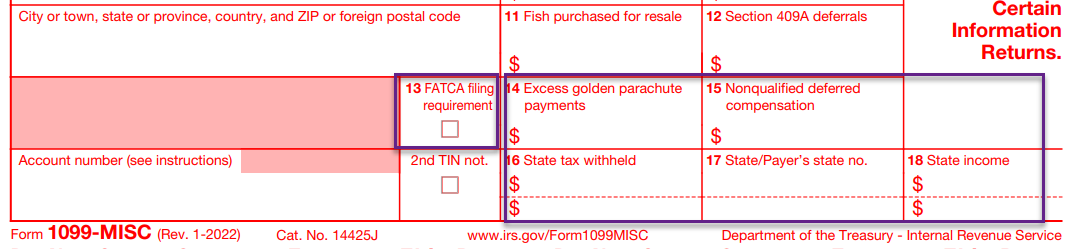

If you are required to file Form 1099-MISC with the IRS this year, you will notice that the form looks slightly different. Here is what you need to know about these updates.

Box 13 is now a checkbox assigned to the Foreign Account Tax Compliance Act (FATCA) filing requirement. Now that this box has been added, the existing boxes 13-17 have been re-numbered as 14-18.

Form 1099-MISC 2021

Form 1099-MISC 2022 (Current)

Form 1099-DIV

Just like on Form 1099-MISC, the FATCA filing requirement checkbox has been added as Box 11. Since this box was added, the existing boxes 11-15 have been re-numbered as 12-16.

Conclusion

In conclusion, the 1099 series of forms are commonly filed by businesses like yours to report a wide range of payments made in the course of the calendar year. They are also a major component of maintaining compliance with the IRS.

When it comes to filing your 1099 Series forms, there are some changes to be aware of. Whether they are the major changes to Form 1099-K, or the minor changes to the boxes on Form 1099-MISC, being aware will help you file successfully.

As you gather the required information needed to complete and file these forms in the new year, keep your filing method in mind. When it comes to filing with the IRS you can either file electronically or submit paper copies. The IRS does actually prefer e-filing, this method allows them to process the forms faster and provide you with status updates. When you mail in paper copies, the IRS is not able to provide any kind of status update for the forms.

We recommend switching to e-filing this tax season, as it is an easier and more efficient process. Hopefully, this article provided you with a helpful overview of the 1099 series, we wish you a happy new year and a successful tax season!

Pranab Bhandari is an Editor of the Financial Blog “Financebuzz”. Apart from writing informative financial articles for his blog, he is a regular contributor to many national and international publications namely Tweak Your Biz, Growth Rocks ETC.