How Does a Professional Help with Your Finance Management?

Everyone needs to have a proper financial management plan to live a life free of budget troubles. However, many of us cannot decipher the complex financial system and end up making poor investment decisions that jeopardize our future financial stability.

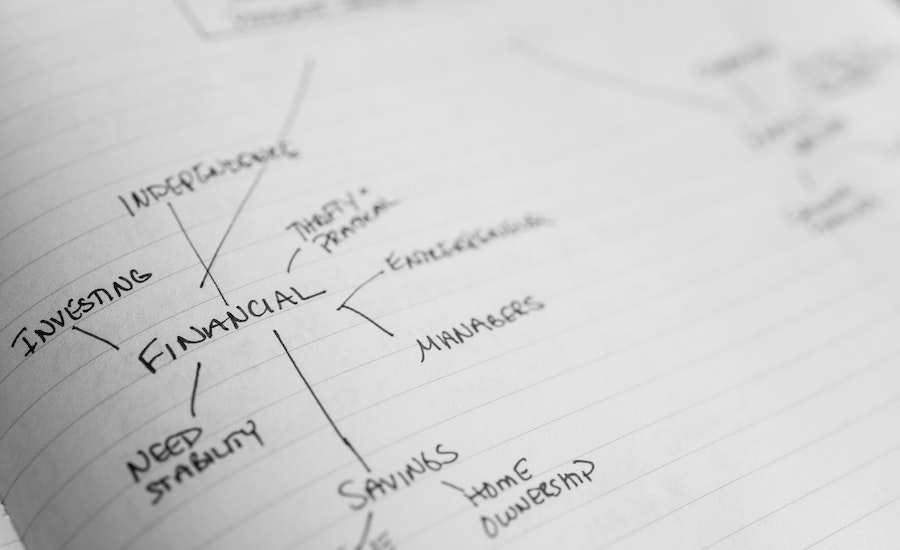

If you lack an understanding of the complexity of financial planning, it’s time to employ a financial advisor to manage your funds. Nowadays financial advisor uses many tools and technology to further enhance their day to day work. Once such tool is Virtual Assistant Services for Financial Advisors. A Virtual Assistant (VA) is a remote worker who provides administrative, organizational, and sometimes specialized support to businesses and professionals, including financial advisors. To have the best financial planning for your future, Consider hiring the best financial audit services that will thoroughly analyze your present financial situation. You can use this to accomplish your long-term and short-term financial objectives. This article will explain how hiring a financial advisor can help you get your finances in order and achieve your financial goals.

1. Doing Your Taxes

Taxes can be challenging for everyone. Dealing with taxes can feel burdensome, particularly as your wealth increases and you come closer to that much-awaited retirement. How taxes may affect your money can be explained in simple terms by a financial advisor.

Their objective is to reduce your tax burden while offering the highest returns, whether that means giving advice on charitable donations, creating a tax-efficient estate plan, or taking full advantage of any tax advantages you may be eligible for. Keep in mind that when hiring your financial advisor, it’s better to hire someone local since they’ll know the local rules and regulations better than anyone else. For example, if you’re a resident of Sacramento, hiring a financial advisor from a Sacramento tax preparation service can be beneficial as the advisor will be knowledgeable of the area’s economy, tax regulations, and cost of living.

2. Investment Planning

Employing a financial advisor can be a wise choice if you’re trying to develop a long-term investing plan. Advisors can assist you in developing the best investment strategy to fulfill your financial objectives and properly plan for retirement.

They can show you how to manage your investments and assist you in determining which mutual funds are best for you. Moreover, financial advisors can also aid you in understanding the risks and steps necessary to accomplish your objectives.

3. Get You Through Volatile Situations

An experienced financial advisor can instruct and guide you through a variety of challenging circumstances. You might not have the time or energy to handle it on your own. For example, suppose you are under the IRS (Internal Revenue Service) microscope and going through an audit. In that case, your financial advisor can handle all the details for you, get your tax papers straight, and manage your balance sheets.

4. Form A Retirement Plan

What would your ideal retirement entail? Do you intend to travel the world? To see your grandchildren? To start your own company? Volunteer in the neighborhood homeless shelter? Regardless of what your dream is, you must have reliable revenue sources to support you for at least two or three decades.

A long-term wealth protection strategy can be developed with the assistance of a financial advisor. They can forecast your future financial requirements and plan ways to maximize your retirement resources. They can guide you on when to withdraw your Required Minimum Distributions (RMDs) from your savings and investments to stay clear of fines. They can also assist you in determining when to draw Social Security benefits.

5. Health and Long-Term Care Planning

A recent study estimates that the healthcare expenses a 65-year-old couple will incur while retiring in 2021 might range from $156,000 to more than $1 million. What can you do to get ready for those significant expenses? A financial advisor can explain your alternatives for long-term care insurance. Then, you can pick a strategy that will be inexpensive both now and afterward when you’ll need it most.

6. Help You Create A Budget

A budget permits you to maximize your savings and spending. It is a great approach to managing your finances and the first step to ensuring long-term financial security. With the help of your financial advisor, you can develop a zero-based budget that will ensure that your money is used as efficiently as possible. You can budget how much money will go toward paying your bills, enjoying yourself, or investing. Your financial advisor can assist you in classifying your expenses into necessary and unnecessary expenditures.

7. Handling Inheritance

If you expect to inherit wealth in the future, you could have many questions about everything, from tax liability to the best ways to use the money. A financial advisor can assist in preventing that blessing from turning into a burden. They can address difficult issues, such as predicted taxes, and advise you on adjusting your financial objectives and methods.

8. Estate Planning

Discussing end-of-life planning may seem downright depressing, but it is still a wise decision. You have the freedom to decide what to do with the possessions you’ve worked so hard to acquire, whether you’ve just purchased your first house or have been operating your own company for years.

If your situation is complicated, consulting a financial advisor or an attorney with expertise in estate planning is essential. They can offer you the guidance you need to develop a plan that will ensure that your wishes are fulfilled.

9. Help Clear Off Debts

Financial advisors assist you in paying off your debt by developing a debt management plan. They pinpoint problematic areas and map out your cash flow in that plan. They can also make a fresh, balanced budget that meets the necessary costs without adding to the debt. They also place focus on eliminating pointless expenses and allocating extra money to debt repayment. The advisor can also assist with debt restructuring so you can pay off high-interest debt first and low-interest debt afterward.

Conclusion

When it comes to budgeting, saving, and investing money to achieve your financial objectives, a financial advisor will prove to be of immense help. You should be aware of the various categories of financial counselors and the services they provide. While some advisors opt to concentrate on offering complete services, such as budgeting, inheritance, and estate planning, others specialize in retirement planning, tax management, and investment planning.

Pranab Bhandari is an Editor of the Financial Blog “Financebuzz”. Apart from writing informative financial articles for his blog, he is a regular contributor to many national and international publications namely Tweak Your Biz, Growth Rocks ETC.